When you pick up a generic prescription, you expect to save money. But over the last decade, those savings have become unpredictable. In 2022, generic drugs made up 90% of all prescriptions filled in the U.S., yet they accounted for just 23% of total drug spending. That sounds like a win-until you look closer. Some generics have dropped in price by 87%. Others? They’ve jumped over 1,200%. This isn’t random. It’s a system shaped by competition, supply chains, and corporate decisions you never see coming.

How Generic Drug Prices Drop-When Competition Arrives

The moment a brand-name drug’s patent expires, the race begins. The first generic maker usually sets a price around 90% of the original brand. That’s still expensive. But when a second company enters, prices often fall to 65%. A third? Down to 52%. By the time four or more companies are making the same drug, prices can plunge to just 15% of the brand’s original cost. This isn’t theory-it’s what the FDA has tracked for years.

Take levothyroxine, the thyroid medication millions rely on. Between 2013 and 2018, as more manufacturers entered the market, its price dropped by 87%. That’s the ideal scenario. But not every drug follows this pattern. Some sit with only one or two makers. And that’s where things go wrong.

The Price Spikes No One Sees Coming

In 2023, a study found that nearly 40 generic drugs saw average price hikes of 39% in just one year. One of them? Nitrofurantoin macrocrystals, an antibiotic for UTIs. Its price jumped over 1,272% between 2013 and 2018. Why? Because only three companies made it. When one of them stopped production, the others raised prices-and no one could step in fast enough.

This isn’t rare. Data from Medicaid shows that between 2013 and 2014, 8.2% of generic prescriptions saw price surges between 100% and 500%. A 2020 Harvard study found that 78% of all price jumps over 100% happened in markets with three or fewer manufacturers. The FDA says it clearly: “The generic drug market functions well when there are multiple competitors, but becomes fragile with three or fewer.”

And it’s not just about how many companies exist-it’s about who owns them. In 2013, there were 150 active generic manufacturers. By 2018, that number dropped to 80. The top 10 now control 70% of the market. When a handful of companies control supply, they can coordinate pricing without breaking any laws. It’s legal. It’s just not fair.

Why Your Prescription Costs More Than Last Year

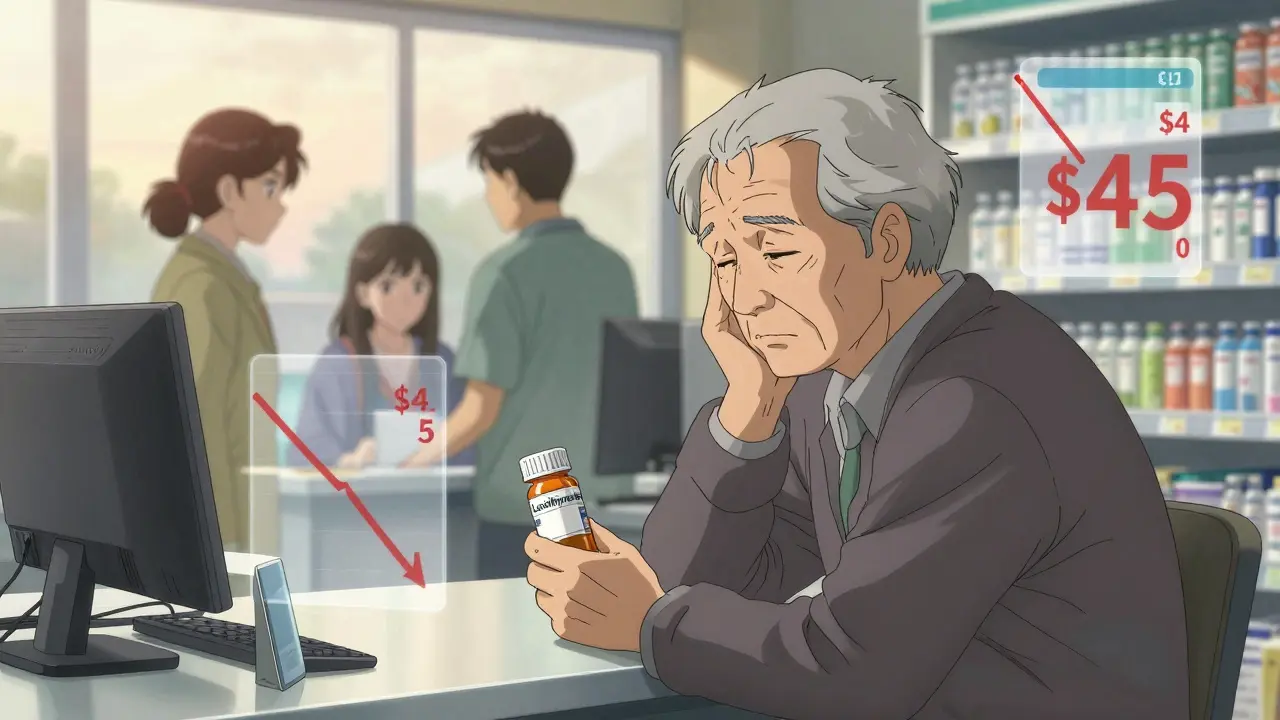

You might not realize it, but your local pharmacy doesn’t set generic drug prices. They buy from wholesalers, who buy from manufacturers. And those prices change daily. One month, a drug costs $4 at Walmart. The next, it’s $45. That happened with lisinopril, a common blood pressure pill. GoodRx data shows its price jumped 247% between January 2022 and December 2023.

Why? Because the manufacturer stopped making it for a few months. Then it came back-but at a higher price. Pharmacies had to pay more. So they passed it on. Independent pharmacies, especially, are getting squeezed. A 2023 survey found that 42% of them saw margin compression on 15% of their generic inventory. Some drugs went from profitable to loss leaders in weeks. And when pharmacies lose money on a drug, they often stop stocking it. That means you might not even be able to get it.

The Hidden Costs Behind the Numbers

Even when prices look low, there’s a catch. The average wholesale price (AWP) you see on paper is often inflated. The real cost-the actual acquisition cost (AAC)-can be 22% lower. But Medicare and Medicaid reimburse based on AWP. That means pharmacies get paid more than they paid for the drug. But when prices spike suddenly, those reimbursements lag. Small pharmacies end up eating the difference.

Then there’s the Medicaid Best Price rule. It forces manufacturers to offer the same price to every buyer-including Medicaid, private insurers, and cash-paying patients. That sounds fair. But it removes their ability to offer discounts to high-volume buyers. So instead of lowering prices to compete, they just raise them across the board.

And don’t forget the supply chain. In 2023, the FDA found quality issues at 23% of foreign manufacturing facilities. When a plant gets shut down for inspections, production stops. If that plant made 80% of the world’s supply of a drug? Prices go up. Fast. The HHS Office of Inspector General found that 35% of drug shortages were tied to price increases over 50%. And those shortages last an average of 6.2 months.

Who Gets Hurt the Most?

It’s not just pharmacies. It’s you. A 2024 KFF survey of Medicare beneficiaries found that 37% of seniors taking generics reported skipping doses because of cost. 28% said they cut pills in half or went without. That’s not laziness. That’s survival.

Meanwhile, the average person using GoodRx saves $112.50 per generic prescription. But not everyone uses it. Older adults, rural residents, and low-income families often don’t know about price-comparison tools. Or they can’t access them. So they pay the pharmacy’s cash price-whatever it is that day.

And here’s the cruel irony: generics account for 8% of Medicare Part D spending-not because they’re expensive, but because they’re used so often. A single drug like apixaban (the generic version of Eliquis) is taken by hundreds of thousands. Even a small price increase on a high-volume drug adds up fast.

What’s Changing in 2025 and Beyond

The Inflation Reduction Act didn’t directly cap generic drug prices. But it did remove the cap on Medicaid rebates, which pushed some brand-name manufacturers to lower prices in early 2024. Generics? Not so much. The system still doesn’t punish price gouging the same way.

The FDA’s 2024 Strategic Plan aims to speed up approvals for drugs with few competitors-targeting a 20% faster review time. That could help. But it won’t fix the root problem: too few manufacturers. The FTC has opened 12 investigations into unjustified price hikes in markets with limited competition. And Congress is starting to ask hard questions about why the U.S. pays 80% more for the same generics than Europe does.

Experts predict that over the next five years, increased FDA focus on competitive generic therapies could reduce high-volatility products by 25%. But supply chain fragility? That’s not going away. Manufacturing is global. Quality control is patchy. And when a single plant in India or China shuts down, prices spike across America.

What You Can Do Right Now

- Use GoodRx or SingleCare. Even if you have insurance, the cash price might be lower.

- Ask your pharmacist if a different generic brand is available. Sometimes switching manufacturers lowers the cost.

- Call around. Prices vary wildly between pharmacies-even within the same chain.

- Request a 90-day supply. Many generics cost less per pill when bought in bulk.

- Check if your drug is on the FDA’s list of shortages. If it is, your pharmacist might have alternatives.

You can’t control the market. But you can control how you pay. Don’t assume your pharmacy’s price is fixed. It’s not. And you don’t have to accept it.

Why do generic drug prices go up even when the drug hasn’t changed?

Generic drug prices rise because of supply shortages, manufacturer consolidation, or production issues-not because the drug itself changed. If only one or two companies make a drug and one stops production, the remaining makers raise prices. Manufacturing delays, FDA inspections, or raw material shortages can trigger these spikes. Even if the pill looks the same, the cost to make it has changed.

Are generic drugs less effective than brand-name drugs?

No. The FDA requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also prove they work the same way in the body. The only differences are inactive ingredients like fillers or dyes, which don’t affect how the drug works. Millions of people safely use generics every day.

Why do some generic drugs cost more than others for the same medication?

Different manufacturers make the same generic drug, and they don’t all charge the same price. One might be selling at a discount to bulk buyers, while another has just raised prices due to low competition. Pharmacies also buy from different wholesalers, which affects their cost. That’s why the same pill can cost $4 at one pharmacy and $45 at another. Always compare prices.

Can I switch to a different generic version of my drug to save money?

Yes, as long as your doctor approves it. Many generics are interchangeable, even if they’re made by different companies. Ask your pharmacist if a lower-cost version of your drug is available. Sometimes switching manufacturers saves you $20-$50 per month. Just make sure the new version is FDA-approved and listed as AB-rated (meaning it’s bioequivalent).

Why do generic drug prices vary so much between states?

It’s not really about the state-it’s about the pharmacy’s supplier and how many competitors exist locally. A pharmacy in a big city might have access to 10 different generic makers, driving prices down. A rural pharmacy might only have one supplier. Also, Medicaid reimbursement rules and state pharmacy benefit managers affect pricing. But the biggest factor? Competition. More competitors = lower prices. Fewer = higher prices.

What’s Next for Generic Drug Prices?

The system isn’t broken-it’s working exactly as designed. But the design favors corporations over consumers. Generic drugs save the U.S. healthcare system over $250 billion a year. Yet, for the 15% of generics with limited competition, prices are volatile, unpredictable, and sometimes unaffordable. Until manufacturers are forced to compete fairly, and supply chains become more resilient, the price of your next prescription will remain a gamble.

Lakisha Sarbah

February 8, 2026 AT 19:31So many people don't realize how wild the pricing is on generics. I got my blood pressure med last month for $4, this month it's $47. My pharmacist just shrugged. No explanation. Just 'prices changed.'

Ashley Hutchins

February 10, 2026 AT 07:04Ugh this is why I hate the system. People act like generics are cheap but its a trap. My mom skipped doses last year cause she couldnt afford her thyroid med. She's 72. And no one cares. Just let em die I guess

Niel Amstrong Stein

February 11, 2026 AT 03:35Honestly? This whole thing feels like a game of monopoly where the only players are Big Pharma and the FDA. We're just the pawns. 🤷♂️

And yet somehow, we're supposed to be grateful when a drug drops from $100 to $80. Meanwhile, the same pill costs $5 in Canada. I mean... really? We're the richest country on earth and we can't fix this? 😅

Joey Gianvincenzi

February 12, 2026 AT 10:28It is imperative to recognize that the structural deficiencies within the pharmaceutical supply chain constitute a systemic failure of public policy. The absence of competitive market mechanisms, coupled with regulatory capture, has engendered a state of economic exploitation that is both ethically indefensible and statistically alarming. One must question the moral legitimacy of a system wherein life-sustaining medication becomes a commodity subject to monopolistic manipulation.

Amit Jain

February 13, 2026 AT 09:47LOL you all think this is bad? Wait till you see what happens when the Chinese factories shut down. You think THIS is a spike? Imagine a world where your insulin costs $1000 because one guy in Shanghai got sick. The whole system is a JOKER. 💀

AMIT JINDAL

February 14, 2026 AT 14:08Let me break this down for you with some deep philosophical insight. The price volatility of generic drugs is not merely an economic phenomenon-it is a metaphysical mirror reflecting the existential fragility of human reliance on industrialized medicine. We have outsourced our health to corporate algorithms and foreign supply chains, forgetting that pills are not just molecules-they are lifelines. And when those lifelines are strangled by oligarchic consolidation, we are forced to confront our own vulnerability. The real question isn't why prices rise-it's why we keep trusting the system that betrays us. 🤔

Ariel Edmisten

February 15, 2026 AT 03:07Use GoodRx. Always. Even if you have insurance. It's free. Takes 30 seconds. Saved me $60 last month.

Catherine Wybourne

February 16, 2026 AT 01:55So... we pay 80% more than Europe for the same pills? And we're surprised when people skip doses? 😏

Let me guess-the next thing they'll say is 'just eat more kale.'

Mary Carroll Allen

February 17, 2026 AT 07:42I just got off the phone with my pharmacy and they said my generic lisinopril went from $5 to $48 in 3 weeks. I asked why. They said 'we don't set prices, we just get what we're given.' Like, what? That's not a business, that's a hostage situation. I cried. Not because I'm weak. Because this is cruel. And nobody's doing anything. #genericdrugcrisis

Eric Knobelspiesse

February 18, 2026 AT 09:43Let's be real. The system isn't broken. It's optimized. Optimized for profit. Optimized for shareholders. Optimized for CEOs who don't take levothyroxine. The fact that 37% of seniors skip doses? That's not a failure. That's a feature. You think they care? Nah. They're too busy counting how much they made off the 1200% spike on nitrofurantoin. 🤑

Ritu Singh

February 20, 2026 AT 05:53As a healthcare professional in India, I can confirm that the global supply chain for active pharmaceutical ingredients is deeply concentrated. Over 70% of our raw materials originate from a handful of plants in China and Gujarat. When one facility fails, the ripple effect is catastrophic. This is not an American problem-it is a global vulnerability. The solution lies not in regulation alone, but in diversification, local manufacturing investment, and international cooperation. We must move beyond profit-driven models to patient-centered resilience.

Mark Harris

February 20, 2026 AT 15:02Just switched to a different generic brand and saved $30 a month. My pharmacist said 'try the blue one instead of the red one.' Seriously. That's all it took. Don't just accept the price. Ask. Always ask.