When a brand-name drug hits the market, its patent clock starts ticking. But that clock doesn’t stop at 20 years. Many blockbuster drugs stay off-limits to generics for another decade or more-not because of the original patent, but because of secondary patents. These aren’t about the active ingredient. They’re about the wrapper, the timing, the form, or even the disease it’s used to treat. And they’re the main reason why some drugs cost hundreds of times more than their generic equivalents-even years after the original patent expires.

What Exactly Are Secondary Patents?

Secondary patents protect anything about a drug that isn’t the chemical itself. Think of the primary patent as the recipe for cake. The secondary patents are the frosting, the pan it’s baked in, the time of day you eat it, or even the fact that it helps with a new kind of headache. The U.S. Patent and Trademark Office allows these as long as they meet basic novelty and non-obviousness rules. But in practice, many are filed not because they’re groundbreaking, but because they’re legal tools to delay competition. There are 12 recognized types. The most common include:- Formulation patents: Protecting a new pill shape, slow-release coating, or liquid version. AstraZeneca’s switch from Prilosec (omeprazole) to Nexium (esomeprazole)-a single-enantiomer version-wasn’t a better drug for most patients. But it extended exclusivity by nearly 8 years.

- Method-of-use patents: Claiming a new medical condition the drug can treat. Thalidomide was originally a sedative. Decades later, it got patents for leprosy and multiple myeloma. Each new use reset the clock.

- Polymorph patents: Protecting a different crystal structure of the same molecule. GlaxoSmithKline’s Paxil patent on Form G delayed generics for four years after the main patent expired.

- Combination patents: Protecting a drug paired with another, even if both were already on the market separately.

These aren’t rare. A single drug like Humira had 264 secondary patents. That’s not innovation-it’s a legal fortress.

How Do They Delay Generic Drugs?

The Hatch-Waxman Act of 1984 created a path for generics to enter the market faster. But it also gave brand companies a way to fight back. When a generic company files for approval, it must check the FDA’s Orange Book-a list of patents tied to the drug. If a patent is listed, the generic maker must either wait, challenge it, or risk a lawsuit. Here’s how it plays out:- Brand company files a secondary patent after the drug is approved.

- They list it in the Orange Book.

- Generic company files a Paragraph IV certification, claiming the patent is invalid or won’t be infringed.

- Brand company sues, triggering a 30-month automatic stay on generic approval.

That 30-month clock doesn’t mean the patent is valid. It just means the generic can’t launch until the court decides-or the brand gives up. Many lawsuits drag on for years. In 2022, 92% of listed secondary patents faced generic challenges. But only 38% of those challenges succeeded in court.

Result? Generic entry is delayed by an average of 2.3 years longer for drugs with secondary patents, according to a 2019 Health Affairs study. For high-revenue drugs, that’s billions in lost sales.

Why Do Companies Invest So Heavily in Them?

It’s pure economics. A drug that earns $1 billion a year sees a 17% increase in secondary patent filings for every additional billion in revenue. Pfizer, Merck, AbbVie-they don’t just file patents. They build thickets. Dozens, sometimes over a hundred, layered over the same product.Why? Because the payoff is huge. Evaluate Pharma found that 58% of a drug’s total lifetime revenue comes during its secondary patent period. That’s not a coincidence. It’s strategy.

And it’s expensive to do. Each secondary patent application costs $12-15 million. Companies hire 15-20 patent attorneys per major drug. They track generic threats 7-10 years in advance. They time new formulations to launch 1-2 years before the primary patent expires, so doctors and patients get used to the new version before generics hit.

That’s called “product hopping.” And it works. A 2022 Medscape survey of doctors found that reps often push the new version right before generics become available. Patients don’t always know the difference. Pharmacies don’t always switch. And insurers end up paying more.

Who Pays the Price?

The cost isn’t just financial. It’s human.Pharmacy benefit managers like Express Scripts say secondary patents raise their annual costs by 8.3%. For Medicare, that means higher premiums and out-of-pocket expenses for seniors. For patients on chronic meds-like Humira, which costs $20 billion a year in the U.S.-the difference between branded and generic can be $10,000 per year.

Knowledge Ecology International points out that if Humira had faced generic competition in 2016, those costs could’ve dropped by 80%. Instead, patients waited until 2023.

But it’s not all bad. Some secondary patents do lead to real improvements. A 2021 American Cancer Society report found that new formulations of chemotherapy drugs reduced severe side effects by 37% in trials. That’s meaningful.

The problem isn’t innovation-it’s the scale of abuse. A 2016 Harvard study found only 12% of secondary patents delivered clinically meaningful benefits. The rest? Legal padding.

How Other Countries Handle It

The U.S. is the outlier. Most developed nations have tighter rules.In India, Section 3(d) of the Patents Act blocks patents on new forms of known drugs unless they show “enhanced efficacy.” That’s why Novartis lost its battle to patent a new crystalline form of Gleevec in 2013. Generic versions flooded the market, cutting the price by 90%.

Brazil requires health ministry approval before a patent can be enforced. The European Union demands “significant clinical benefit” for certain secondary patents. Even the WHO calls secondary patents the main legal barrier to affordable medicines in 68 low- and middle-income countries.

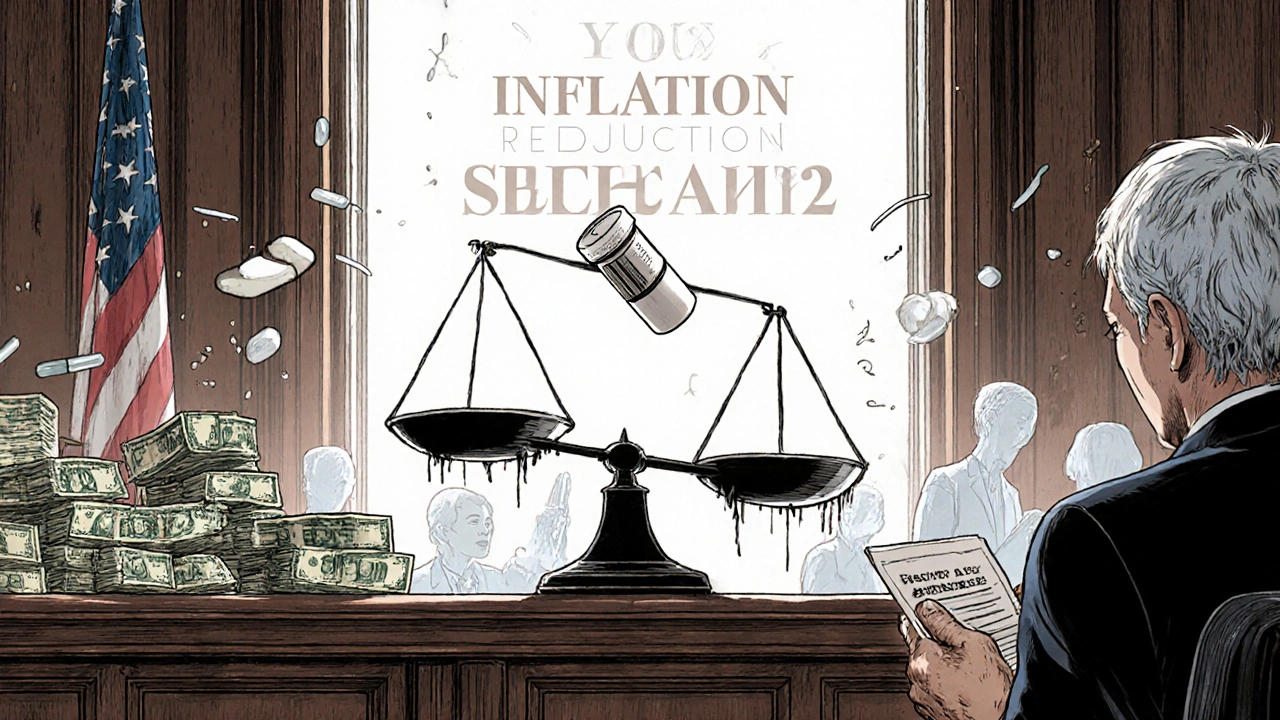

The U.S. is starting to push back. The 2022 Inflation Reduction Act lets Medicare challenge certain secondary patents. The European Commission’s 2023 Pharmaceutical Strategy targets patent thickets. Courts are getting stricter too. The 2023 Amgen v. Sanofi ruling limited broad antibody patents, a sign that judges are tired of vague claims.

The Future of Secondary Patents

The game isn’t over-but it’s changing.Companies aren’t giving up. They’re adapting. More are combining secondary patents with regulatory exclusivity (like orphan drug status) and data protection periods. Some are focusing on truly novel delivery systems or combo therapies with real patient benefits.

But the pressure is mounting. Public opinion is shifting. Politicians are talking about drug pricing. Courts are tightening standards. And generics are getting smarter-filing more challenges, using data to prove patents are obvious.

Dr. Roger Longman of Windhover Information predicts that by 2027, companies will need to prove their secondary patents offer real clinical value-or face rejection. That’s a big shift from the past 20 years.

For now, the system still favors brand companies. But the tide is turning. The next decade will decide whether secondary patents are a tool for innovation-or a loophole for profit.

Are secondary patents legal?

Yes, secondary patents are legal in the U.S. and many other countries. The patent system allows them as long as they meet basic criteria for novelty and non-obviousness. But legality doesn’t mean they’re always justified. Many are filed not to protect innovation, but to delay competition. Courts and regulators are starting to question whether some meet the true standard for patentability.

How do secondary patents affect drug prices?

They keep prices high. When a brand drug has secondary patents, generic versions can’t enter the market-even after the original patent expires. This delays price drops by an average of 2.3 years. For high-cost drugs like Humira, that means billions in extra spending by patients, insurers, and government programs. One study found that secondary patents raise pharmacy benefit manager costs by 8.3% annually.

Can a generic drug maker challenge a secondary patent?

Yes. Generic companies can file a Paragraph IV certification with the FDA, claiming the patent is invalid or won’t be infringed. This triggers a lawsuit from the brand company, which can delay generic approval by up to 30 months. But only about 38% of these challenges succeed in court. Still, many brands settle to avoid risk, allowing generics to enter earlier than expected.

Why do some countries block secondary patents?

Countries like India and Brazil restrict secondary patents to ensure access to affordable medicines. India’s Section 3(d) requires new versions of known drugs to show significantly improved efficacy-not just a different form or salt. This prevents “evergreening” and lets generics enter sooner. These policies are deliberate choices to balance innovation with public health.

Do secondary patents help patients?

Sometimes. A small percentage-around 12%-lead to real improvements, like fewer side effects, better dosing, or new uses for rare diseases. For example, new formulations of cancer drugs have reduced severe reactions by 37% in some trials. But most secondary patents offer little to no clinical benefit. The majority are designed to extend profits, not improve care.

Andy Slack

November 10, 2025 AT 23:25This is wild. I had no idea drug companies were stacking patents like LEGO towers just to keep prices high. The fact that Nexium was basically the same as Prilosec but with a fancy name and a new patent still blows my mind. Patients are getting screwed while CEOs cash in.

Rashmi Mohapatra

November 11, 2025 AT 02:33in india we call this evergreening and its bullshit. section 3(d) saved lives. novartis tried to patent gleevec in a diff crystal form and got slapped hard. generics came in, price dropped 90%. why cant usa do the same? people die waiting for meds to get cheap.

Ankit Yadav

November 11, 2025 AT 04:11It's not just about patents-it's about access. When a drug like Humira costs $20k a year and the generic could be $4k, we're not talking about corporate profits. We're talking about diabetics skipping doses, seniors choosing between food and insulin. The system isn't broken. It was designed this way.

But change is coming. Courts are waking up. The IRA is a start. And patients are getting louder. We need more countries to follow India's lead-not just because it's fair, but because it's sustainable.

Meghan Rose

November 11, 2025 AT 16:41Wait, so you're saying doctors don't even know the difference between the branded and generic versions? And pharmacies just keep giving the expensive one? That's insane. My aunt takes Humira and has no idea she could save $10k a year. Why isn't this on the news every night? Someone should sue these companies for fraud.

Steve Phillips

November 12, 2025 AT 18:18Oh, so let me get this straight: Big Pharma doesn't innovate-they just repackage the same molecule like a magician pulling a rabbit from a hat? And we call this 'intellectual property'? Please. This isn't capitalism-it's legalized extortion. They're not selling medicine. They're selling a monopoly wrapped in a lab coat. The patent office is a corporate shill. And the FDA? A rubber stamp with a fancy seal.

And don't even get me started on the 'product hopping' scam. It's like if Apple released the iPhone 15.1 with a slightly different shade of black and said, 'Nope, your iPhone 15 is obsolete now.' Genius. Or just greedy. Either way, it's criminal.

Rachel Puno

November 14, 2025 AT 17:00Thank you for writing this. I work in public health and see the damage every day. But I also want to say-some of these patents DO help. That new chemo formulation that cuts side effects by 37%? That’s real. We shouldn’t throw the baby out with the bathwater. The goal isn’t to eliminate secondary patents-it’s to stop the abuse. We need better standards, not just more lawsuits.

And patients deserve transparency. If a new version isn’t clinically better, they should know. Doctors should be forced to say: 'This is the same drug, just more expensive.' Simple. Human. Necessary.

Clyde Verdin Jr

November 16, 2025 AT 14:21Y’all are acting like this is a surprise. Big Pharma is a cartel. They’ve been doing this since the 70s. The only thing new is that people finally noticed. Meanwhile, the same CEOs who profit from this are donating to politicians who vote against drug pricing reform. It’s a circus. And we’re all clowns in the front row paying $300 for a Band-Aid that costs $3 to make.

Also, I’m 90% sure the FDA gets a kickback. Just saying.

Key Davis

November 18, 2025 AT 02:08While the ethical implications of secondary patenting are profound, it is imperative to acknowledge the structural incentives embedded within the current legal and economic framework. The patent system, as codified in the United States, was designed to encourage innovation through exclusivity. However, the expansion of patentable subject matter-particularly in pharmaceuticals-has created a misalignment between statutory intent and market outcomes.

Comparative jurisprudence reveals that nations such as India and Brazil have adopted a public health-oriented interpretation of patentability, prioritizing therapeutic efficacy over structural novelty. This paradigm, grounded in the principle of equitable access, may serve as a model for reform. The Inflation Reduction Act represents a modest but meaningful step toward recalibrating this balance.

Ultimately, the challenge lies not in abolishing secondary patents, but in establishing objective, clinically grounded criteria for their validity-a standard that prioritizes patient welfare over shareholder value.

Cris Ceceris

November 19, 2025 AT 22:44I keep thinking about the human side. Not the lawsuits, not the profits, not even the patents. I think about the person who has to choose between their medication and their kid's school supplies. Or the elderly person who splits their pills in half because they can't afford the full dose. That's the real cost of this system.

It's not just about whether something is legal. It's about whether it's right. And if we're okay with a system where a company can extend a monopoly for a drug that does literally nothing better than the original-just to make more money-then what does that say about us?

Maybe the real innovation we need isn't in chemistry. Maybe it's in our collective conscience.