When you pick up a prescription, do you ever wonder why your copay for one pill is $5 and for another it’s $80? It’s not because one is stronger or works better. It’s because of your insurance’s formulary-the list of drugs they cover and how much you pay for each. And the biggest divide? Generics versus brand-name drugs.

At first glance, they look the same. Same name on the bottle, same shape, same color. But under the hood, insurance treats them like two completely different things. And that difference can save-or cost-you hundreds a month.

How Insurance Tier Systems Work

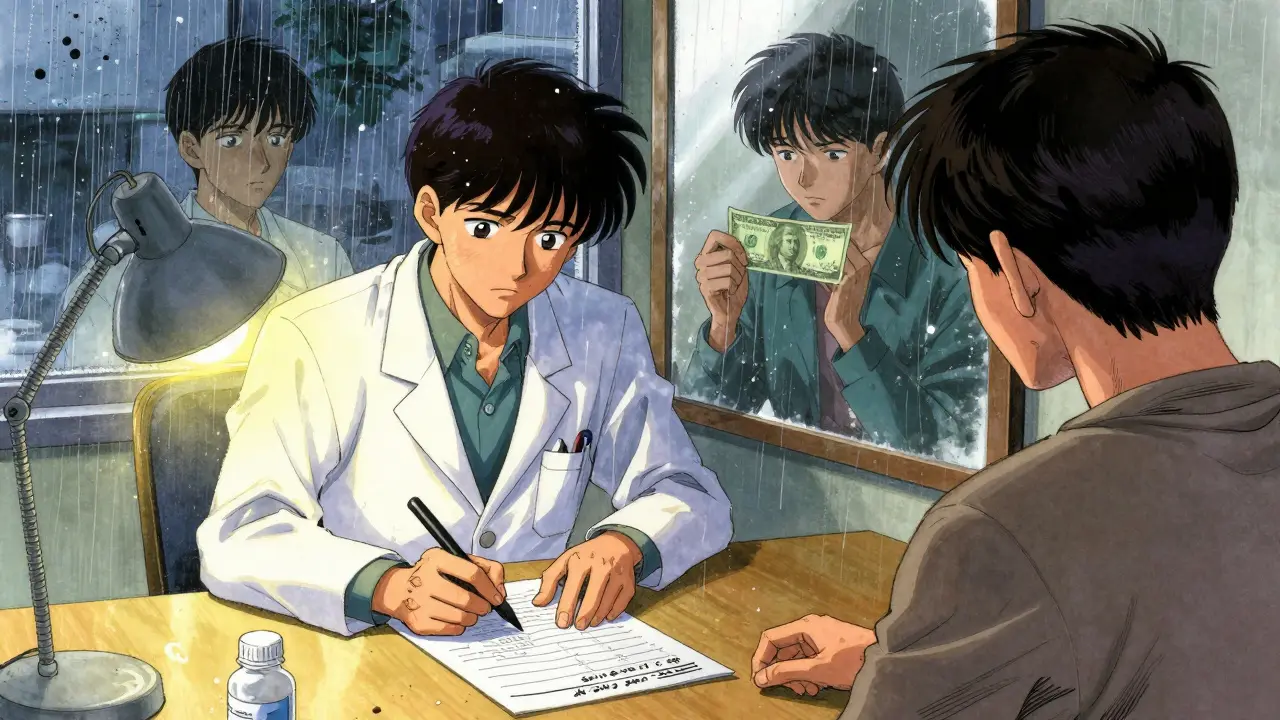

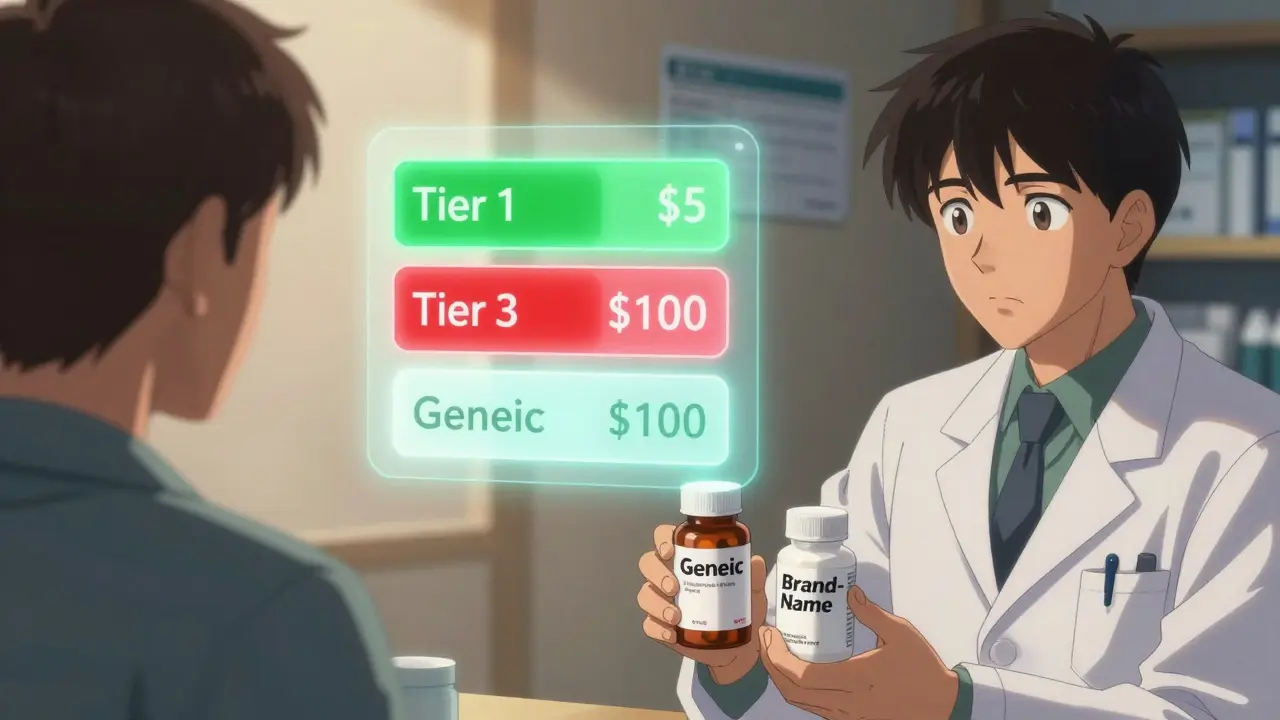

Your insurance plan doesn’t treat all drugs the same. It sorts them into tiers, like levels in a video game. The lower the tier, the less you pay.

Generics almost always land on Tier 1. That’s the cheapest tier. For a 30-day supply, you might pay $5 to $15. That’s it. No surprise fees. No hidden charges.

Brand-name drugs? They usually show up on Tier 2 or Tier 3. Copays here jump to $40-$100. Some plans don’t even use fixed copays-they charge you a percentage of the drug’s full price, like 25% to 33%. That means if the brand costs $300, you pay $75. If the generic costs $10, you pay $2.50. The math doesn’t lie.

Why the gap? Because generics don’t carry the same R&D costs. Brand-name companies spent years and millions developing the drug. Generics? They just copy it. And because they don’t have those upfront costs, they can sell for way less. Insurance companies know this. So they push you toward generics-not because they’re cheaper to make, but because they’re cheaper for you to take.

Substitution Rules: You Don’t Always Get a Choice

Here’s where it gets tricky: you might not even get to choose.

In all 50 states, pharmacists are allowed to swap a brand-name drug for a generic-unless your doctor specifically says “do not substitute.” That’s called “dispense as written.” If your prescription doesn’t have that note, the pharmacist will almost always give you the generic. And your insurance will only cover the generic price.

But here’s the catch: if you want the brand anyway, you’re not just paying the brand price. You’re paying the brand price plus the difference between the brand and the generic. So if the brand costs $120 and the generic costs $8, you pay $120. But if your insurance only covers $8, you’re on the hook for the other $112. That’s a $112 surprise at the pharmacy counter.

Medicare Part D does the same thing. In fact, 91% of prescriptions filled under Medicare in 2022 were generics. And if you try to skip the generic, you’ll pay more-often a lot more.

Why Some Drugs Don’t Get Replaced

Not all drugs are created equal. Some medicines have what’s called a narrow therapeutic index. That means even a tiny change in dosage can cause big problems. Think warfarin (blood thinner), levothyroxine (thyroid hormone), or phenytoin (seizure control).

For these, 27 states have special rules. Even if a generic exists, your insurance must cover the brand if your doctor says it’s medically necessary. Why? Because some patients report side effects or reduced effectiveness when switching-even though the active ingredient is identical. A 2022 study in JAMA Neurology found seizure rates went up 12.3% in patients switched from brand to generic antiepileptics.

That’s why doctors can write “medical necessity” on prescriptions. Forty-two states let them do this without extra paperwork. Eight states? Not so much. And even in states where it’s allowed, you might need to prove you tried at least three generics before the insurer approves the brand. That can mean weeks of trial, error, and frustration.

Insurance Tricks You Might Not Know

Insurance companies don’t just use tiers. They use other tools to control costs:

- Prior authorization: For brand-name drugs, 22.7% of prescriptions require approval before filling. For generics? Only 2.1%.

- Step therapy: You have to try the generic first. Only if it fails can you move to the brand. This applies to over a third of specialty drugs.

- Formulary changes: Your plan can drop a brand from coverage at any time. If that happens, you might be forced to switch-even if you’ve been stable for years.

One 2022 survey found 34% of insured patients didn’t understand when generics were required. And 19% skipped filling prescriptions because they feared a surprise bill. That’s not just confusing-it’s dangerous.

What About Brand-Name Manufacturers?

You’d think drugmakers would fight this. But many have a workaround: authorized generics.

That’s when the original brand company makes its own generic version. It’s chemically identical, but it’s sold under a different name. These are often covered better than third-party generics because insurers see them as “the same as the brand.” In 2023, 46% of all generic prescriptions were authorized generics.

And then there are copay cards. Brand manufacturers offer them to reduce your out-of-pocket cost to $0-$10. But here’s the catch: they’re banned for Medicare and Medicaid patients. So if you’re on Medicare, you’re stuck with the full cost unless you qualify for a subsidy.

What’s Changing in 2025?

Things are shifting. The FDA is requiring clearer labeling on generics starting in 2025. That means you’ll see ratings like “AB” (therapeutically equivalent) or “BX” (not equivalent) right on the bottle. That’ll help pharmacies and insurers make better decisions.

Medicare is also stepping in. By 2024, prior authorizations for brand-name drugs must be decided within 72 hours-down from the current 14-day wait in some cases. That’s a win for patients stuck in limbo.

And the Inflation Reduction Act? It caps insulin at $35 and puts a $2,000 annual out-of-pocket limit on Part D drugs starting in 2025. That’ll help people on expensive brand-name drugs-but only if they’re still covered.

What Should You Do?

Here’s how to navigate this:

- Check your plan’s formulary. Look up your drug on your insurer’s website. See what tier it’s on.

- Ask your pharmacist: “Is there a generic? If I switch, will my copay drop?”

- If you’re on a narrow therapeutic index drug, ask your doctor to write “dispense as written.”

- Don’t assume generics are always safe. If you feel worse after a switch, speak up. Document symptoms. Ask for a medical exception.

- For Medicare users: Use the Plan Finder tool. Compare plans before open enrollment. Coverage changes every year.

The bottom line? Generics aren’t just cheaper. They’re the default. And insurance plans are designed to make you take them. But you have rights. You have options. And if you’re paying more than you should, it’s probably because you didn’t ask.

Are generic drugs really the same as brand-name drugs?

Yes-by FDA standards. Generics must contain the same active ingredient, strength, dosage form, and route of administration as the brand. They must also meet the same standards for safety, purity, and effectiveness. The FDA requires bioequivalence testing to prove they work the same way in the body. However, inactive ingredients (like fillers or dyes) can differ, and some patients report side effects or reduced effectiveness after switching, especially with narrow therapeutic index drugs like levothyroxine or warfarin.

Why do insurance plans favor generics so strongly?

Because generics save money-for both the insurer and the patient. Generic drugs cost 80%-85% less than brand-name versions. In 2022, generics made up 90% of all U.S. prescriptions but only 23% of drug spending, saving the system $370 billion that year. Insurance companies use tiered formularies and substitution rules to steer patients toward generics, reducing overall costs and lowering premiums.

Can I refuse a generic and still get my brand-name drug covered?

Yes, but it’s not automatic. You need your doctor to write “dispense as written” on the prescription. Even then, your insurance might still require prior authorization or step therapy. For Medicare and Medicaid, you’ll likely pay the full difference between brand and generic price. Some states allow medical necessity exceptions based on documented side effects or therapeutic failure after trying at least two generics.

Why do some people have problems switching from brand to generic?

While the active ingredient is identical, inactive ingredients (like binders, dyes, or preservatives) can vary between manufacturers. For some patients, especially those with sensitivities or chronic conditions like epilepsy, thyroid disease, or depression, these differences can affect absorption or trigger side effects. Studies show 68% of physicians report patients experiencing different reactions after switching. For drugs with a narrow therapeutic index, even small changes can lead to therapeutic failure.

What’s the difference between a generic and an authorized generic?

An authorized generic is made by the original brand-name manufacturer but sold under a different name, often at a lower price. It’s chemically identical to the brand and sometimes has better insurance coverage than third-party generics because insurers treat it as “the real thing.” In 2023, 46% of all generic prescriptions were authorized generics. Third-party generics are made by other companies and may have different inactive ingredients or manufacturing standards.

What’s Next?

If you’re on a brand-name drug and your copay keeps rising, don’t just accept it. Ask questions. Check your formulary. Talk to your pharmacist. Request a medical exception if needed. And if you’re on Medicare, review your plan every year-coverage changes, and so do costs. The system is built to push you toward generics. But you still have control. Use it.

Chelsea Cook

February 10, 2026 AT 05:39So let me get this straight - insurance companies are basically playing Tetris with our health, and generics are the green block they keep shoving in to clear the line? 😏

I got prescribed levothyroxine last year. Switched to generic. Suddenly I felt like a zombie who forgot how to function. Turned out my body didn’t care for the new filler. Doctor had to fight my insurer for 3 weeks just to get me back on brand. And no, I didn’t get reimbursed for the $112 I paid out of pocket. Thanks, capitalism.

Also, why is it that when I ask for the brand, they act like I’m asking for a gold-plated kidney? It’s not a luxury. It’s my thyroid. My life. My sleep. My ability to not cry at commercials for dog food.

And don’t even get me started on authorized generics. That’s just the brand in a cheap suit. Same product, different label, same price gouging. Insurance loves it because they think we’re dumb enough not to notice. Spoiler: we notice.

PS: If your doctor didn’t write ‘dispense as written,’ you’re basically gambling with your health. And nobody wins at that game.

Jessica Klaar

February 10, 2026 AT 17:47I’ve been working in pharmacy for 12 years, and I’ve seen this play out way too many times.

Patients come in so confused. They don’t understand why their $5 generic suddenly became $78. They don’t know what ‘formulary’ even means. And when they ask, the pharmacist just shrugs and says, ‘That’s what your plan says.’

But here’s the thing - most people don’t realize they can ask for a prior auth or a medical exception. You don’t have to just accept it. You have rights. You just have to know how to fight for them.

I had a 72-year-old woman last month who was on warfarin for 15 years. Switched to generic. INR went wild. She almost had a stroke. We got her back on brand after three appeals. She cried. I cried. We all cried.

Generics are great - but not when they’re forced on people who aren’t candidates. We need more empathy in this system, not more spreadsheets.

PAUL MCQUEEN

February 11, 2026 AT 14:18Wow. This post is basically just a 2,000-word LinkedIn article dressed up like a Reddit thread.

Nothing here that isn’t common knowledge if you’ve ever had insurance. The ‘surprise’ is that people are shocked generics cost less? Groundbreaking.

Also, ‘narrow therapeutic index’? Please. That’s just fancy talk for ‘some people are weird.’

And let’s not forget the real issue: the fact that brand-name companies are still allowed to charge $300 for a pill that costs $2 to make. That’s the real problem. Not the generics. Not the insurers. The pharma execs.

But sure, let’s blame the pharmacist for giving you the cheaper option. That makes sense.

glenn mendoza

February 11, 2026 AT 21:11It is with considerable regard for public health policy and equitable access to pharmaceutical care that I offer the following perspective.

The structural incentives embedded within third-party payer systems are demonstrably aligned with cost containment objectives, which, while economically rational, may inadvertently compromise therapeutic continuity for vulnerable populations.

Empirical evidence from the Journal of the American Medical Association indicates that substitution protocols, while statistically effective at reducing aggregate expenditures, may induce clinically significant variability in outcomes among patients with conditions governed by narrow therapeutic indices.

Therefore, it is imperative that healthcare providers advocate for patient-specific formulary exceptions, and that regulatory frameworks evolve to prioritize clinical autonomy over fiscal efficiency.

Thank you for bringing this critical issue to light. This discourse is long overdue.

Randy Harkins

February 12, 2026 AT 01:44Yessss this is so important 💯

I had to switch my anxiety med from brand to generic last year. Felt like I was being slowly drained of my soul. My therapist noticed. My dog stopped cuddling with me. My cat started hissing. I swear.

I went back to brand and now I’m back to human. And yes, I pay $80 a month. But I’d rather pay $80 and not cry in the shower every day.

Also - authorized generics? They’re the OGs. The real deal. The brand’s little sibling who still gets invited to family dinners. Use those if you can.

And if your doctor won’t write ‘dispense as written’ - find a new doctor. Seriously.

Chima Ifeanyi

February 13, 2026 AT 23:08Let’s deconstruct the neoliberal pharmacoeconomic paradigm here.

The formulary tiering mechanism is a classic example of asymmetric information exploitation - insurers leverage opaque pricing structures to externalize cost burdens onto the patient while maintaining the illusion of cost-sharing.

Moreover, the ‘dispense as written’ provision is not a patient right - it’s a regulatory loophole that varies by state jurisdiction, revealing the fragmented, state-centric nature of U.S. pharmaceutical governance.

And let’s not ignore the rent-seeking behavior of authorized generics - a monopolistic maneuver by originator firms to preserve market share under the guise of accessibility.

The real solution? Single-payer. Universal formulary. End the patent cartel. But no, we’ll keep playing ‘Guess the Copay’ instead.

THANGAVEL PARASAKTHI

February 14, 2026 AT 12:21bro i got switched to generic for my blood pressure med and my head started spinning like a top

my doc said 'it's the same thing' but i swear it felt different

had to pay extra to get brand back

insurance said 'nope no coverage' so i paid out of pocket

now i just keep the brand in my drawer

its not about money its about not feeling like i'm dying

Chelsea Deflyss

February 16, 2026 AT 01:26So you’re telling me I paid $120 for a pill and got a generic that made me feel like a zombie… and now I have to prove to my insurance I’m not crazy? 😭

My doctor wrote 'dispense as written' but they still made me fill out 7 forms. 7. I had to fax something. In 2024.

And then they denied it. So I just stopped taking it. Now I have panic attacks. But hey, my insurance saved $112.

Also, I’m not a doctor but I know what I feel. And I feel like I’m being gaslit by a spreadsheet.

Tatiana Barbosa

February 17, 2026 AT 01:20Generics are the MVP of the healthcare system - until they’re not

My mom’s on levothyroxine. Switched to generic. TSH went from 2.1 to 8.7. She went from 'I’m fine' to 'I can’t get out of bed' in 2 weeks

Insurance said 'try another generic' - like that’s gonna help

Doc had to appeal. Took 45 days. She lost 12 lbs. Lost her job. Lost her confidence

Now she’s on brand. Still paying $90. But she’s alive. That’s the win

Stop acting like this is just math. It’s people. Real people. With real bodies

Random Guy

February 17, 2026 AT 06:28MY DOCTOR WROTE 'DO NOT SUBSTITUTE' AND THEY STILL GAVE ME THE GENERIC

I went to the pharmacy. Asked 'is this the brand?'

Pharmacist said 'yes'.

I looked at the bottle. It said 'TEVA'.

I screamed.

They gave me a refund. And a free lanyard.

Now I carry my prescription in a backpack like a ninja.

Also - I love authorized generics. They’re like the brand’s cousin who actually shows up to family reunions.

Simon Critchley

February 18, 2026 AT 03:21Let’s talk about the elephant in the room: the FDA’s AB/BX rating system. It’s a joke.

AB means 'therapeutically equivalent' - but equivalent under what conditions? In healthy volunteers? In a lab? Not in a 78-year-old with renal impairment.

And what’s with the 'BX' designation? It’s buried in a 300-page PDF no one reads.

Insurance companies use these ratings like gospel. But they’re not clinical guidelines - they’re statistical approximations.

Meanwhile, patients are being treated like data points in a cost-benefit algorithm.

And don’t get me started on copay cards. They’re not charity. They’re marketing. And Medicare patients? Left in the dust.

Karianne Jackson

February 19, 2026 AT 11:57I just got kicked off my brand med and now I feel like garbage

My insurance said 'try the generic'

I did

I cried

I went back

They said 'no'

I paid $150 out of pocket

Worth it

John McDonald

February 21, 2026 AT 01:38Look - I get it. Generics save money. They’re safe. Most of the time, they work.

But this whole system is built on the assumption that everyone’s body reacts the same. And that’s just not true.

I’ve been on the same med for 10 years. Switched to generic last year. My anxiety spiked. My sleep vanished. I went to my doctor - he said, 'It’s probably coincidence.'

I said, 'I’ve been on this for a decade. I know what 'coincidence' looks like.'

He wrote 'dispense as written.' Took 3 weeks. I paid $110.

Now I’m fine.

So yeah - generics are great. But not when they’re forced.

And if your doctor won’t fight for you? Find one who will.